Contents

- Nasdaq Futures

- What are the Opportunities and Risks of Stock Investing in Japan?

- Japan Stock Market Index (JP 2023 Data – 1965-2022 Historical – 2024 Forecast

- Risk associated with investing in Japan stocks

- Index futures other than TAIEX Futures and Nikkei 225 VI Futures

- What is the best way to invest in Japanese stocks?

While share dealing involves buying and selling the underlying asset, trading this way allows Japanese stock traders to speculate on the price of the asset without actually owning it. It also allows you to trade using leverage, which magnifies your exposure. With the rise of online trading platforms in Japan, trading US stocks became easier and more accessible for Japanese traders. The US stock market is now more accessible then ever for Japan traders whatever their level. Japan’s stock market provides traders and investors access to stable and well-established companies.

In either approach, strong risk management principles are essential. It is important you understand what your overall risk is on a trade. You can use the Admiral Markets Trading Calculator to help identify your risk and margin requirements for different instruments .

You should conduct your own research before deciding on the most suitable investment tool for you. The US dollar to Japanese yen (USD/JPY) exchange rate crossed 150 level for the first time since 1990 in late October. While stocks in other developed nations have crumbled amid concerns about inflation and tightening monetary cycle in 2022, Japan stocks have managed to weather the storm. In 2012, Shinzo Abe, Japan’s Prime Minister, began a programme of reform called Abenomics.

Nasdaq Futures

But with traditional trading, you buy the assets for the full amount. In the UK, there is no stamp duty on CFD trading, but there is when you buy stocks, for example. You can still benefit if the market moves in your favour, or make a loss if it moves against you. However, with traditional trading you enter a contract to exchange the legal ownership of the individual shares or the commodities for money, and you own this until you sell it again. For ETFs, ETNs and leveraged products, if the auction closes at the upper price, the upper daily price limit will be broadened from the next business day.

The Tokyo Stock Price Index is another major index on the Tokyo Stock Exchange. Unlike the Nikkei 225, which is comprised of 225 selected stocks, TOPIX is calculated with all the stocks on the TSE using the market value weighted method. Though the Nikkei 225 is the most frequently quoted index for the Japanese stock market, there are a number of other popular related indices.

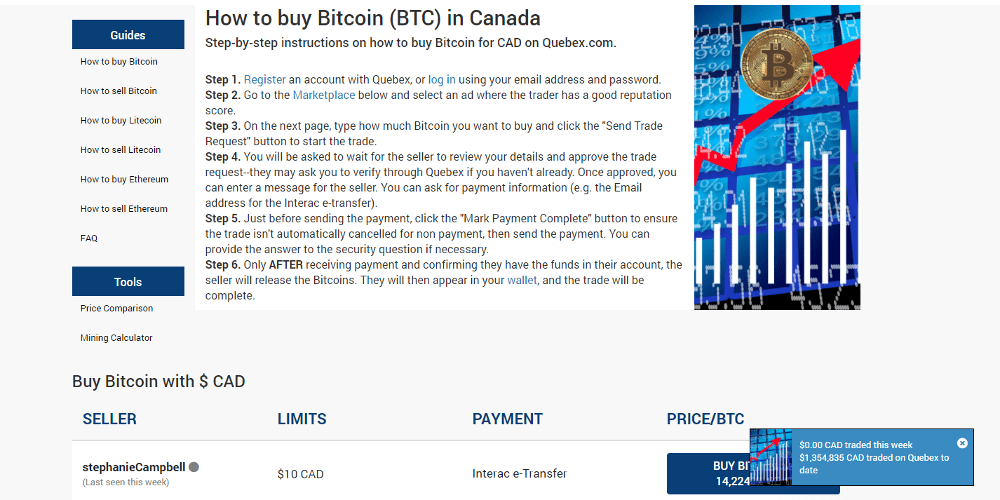

CFDs are a very high risk trade allowing Japan traders to speculate on US stock price movements up or down using leverage and trading with greater exposure to the market than your deposited amount. You may lose more than your deposited amount when trading a US stock CFD. If you’re planning to buy US shares from a Japan trading platform, you should choose one that offers you the best value. A full-service brokerage firm in Japan will offer you the best rates. But if you’re inexperienced and would like some beginner friendly trading features like copy trading, you can also start by using an Japan online stock broker.

- Questrade is considered safe because it has a long track record and is regulated by a top-tier regulator.

- For example, the US stock market has outperformed the global and local Japan market four out of the last five years, and that has increased investor interest.

- As such, they will offer a broader range of products and services for Japan traders.

- The US Stock Exchange in Japan is the main stock market in the United States.

- The index opened 2022 at 29,301, but gradually fell, touching 16-month lows at 24,681 on 9 March.

- Choosing a diversified portfolio should be a goal for all investors in Japan.

If you’re looking for a higher risk way to make money using leverage in the US stock market, CFD trading and spread betting on US shares may be an option to Japan traders. Spread betting uses a system where you stake a certain amount of money on one point and then trade that amount of money at a higher price if the point goes up. While CFD trading in Japan requires a certain amount of capital, spread betting requires a much lower investment amount. Understand that you do not own any underlying US stocks when trading US stocks as CFDS.

What are the Opportunities and Risks of Stock Investing in Japan?

It is important to know that direct investment into Japanese stocks on Japan’s stock exchanges is done in local currency – the Japanese yen. So all these trades should be hedged into your local currency, whatever it is – USD, EUR, CHF, CAD. Investing in US stocks is considered capital gains for traders in Japan. While you can invest in US stocks without paying any taxes, it is important to remember that you’ll have to pay taxes on any gains you make from US stocks. Buying US stocks in a TFSA can be tax-free for Japan investors who have the right documents. In the end, it’s important to make sure you are tax-free before you buy a TFSA.

When the economy is healthy, stocks can survive the worst. A positive turnaround can be very difficult to predict, but it is one of the reasons why it’s worth Japan traders considering investing in US stocks. Today, there are many online forex broker rating US stock trading platforms that allow Japanese citizens to buy and sell shares in US publicly-traded companies. To help you to find the online brokers & trading platforms in Japan in 2023, we went ahead and did the research for you.

Japan Stock Market Index (JP 2023 Data – 1965-2022 Historical – 2024 Forecast

Another factor is the ability to sell the stock easily and without incurring additional fees. A US stock that has good liquidity is easier to sell for a Japan trader, than one with little or no liquidity, which could lead to larger losses. For Japanese US stock traders to claim a reduced rate of withholding or exemption from taxation, foreign persons must complete a W-8BEN form.

Conversely, value stocks are those of well-established companies. They typically pay high dividend yields and generate steady earnings, but are slower growing than growth stocks. Still, you should be aware of the risks involved and the losses that can occur. Interactive Brokers is the best international instaforex review online broker in 2021. Interactive Brokers, one of the biggest US-based discount brokers, was founded in 1978. The broker is regulated by several financial authorities globally, including top-tier ones like the UK’s Financial Conduct Authority and the US Securities and Exchange Commission .

Even though the Japan has Tokyo Stock ExchangeJapanese traders, look to US tech stock markets and US Indices like the NASDAQ, NYSE and SP500 to diversify their Japan stock portfolios. Once you’ve completed the steps outlined above, you’ll have a live stock trading account open with either an international or a Japanese broker. You will also need to gain access to a trading platform supported by your chosen broker to enter your trades if you wish to do so online. Now the Bank of Japan is trying something different – attempting to raise stock prices in the hope it will increase consumer spending in the economy. The bank has been buying assets such as exchange-traded funds which hold publicly listed companies in an attempt to lift stock prices. They are now one of the biggest holders of stocks listed on the Tokyo Stock Exchange and is now one of the top five owners of 81 different companies.

Once you’ve established your login credentials, you can proceed to the registration, funding and US stock technical analysis steps. If you want to diversify your Japan portfolio, the US stock market is one of the top choices. First of all, US stocks have the advantage of being open to all. Japanese investors can invest in US stocks as soon as their Japan stock trading account is verified and funded. In fact, the US stock market is widely accessible to everyone in Japan, and its thriving, well-regulated environment is an added bonus.

Risk associated with investing in Japan stocks

The term market cap refers to the total value of a company when you add up all its outstanding stock, and you can’t add up to a greater sum than these organizations. Meet the giants of Japan industry, the towering behemoths of economic endeavor — the majestical roof of the business, fretted with golden gains. Please refer to the link below for the method of determining the base price of multiply-listed foreign issues and «Issues Designated by TSE based on the Number of Active Trading Days». Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Let’s find out if you are one of the 4 zodiac signs that are predicted to be painful in love. Will your zodiac sign be lucky or unlucky on January 19, 2023? Knowinsiders.com’s daily horoscope predicts your love, money, work and health fortunes throughout the day. Questrade is considered safe because it has a long track record and is regulated by a top-tier regulator. Money Since making that peak in 1989, the Nikkei 225 Index has traded under the 8,000 level twice, initially in 2003 and then in 2009. The index currently trades at the 26,652.52 level and had a yearly range of 16,358.19 to 26,894.25 thus far in 2020.

Please see the SelectUSA FDI Fact Sheet on Japan and the SelectUSA Investor Guide. Stay on top of current data on the stock market in Japan, including leading stocks as well as large and small cap stocks. There are a handful of ETFs traded in U.S. markets that make gaining exposure to Japan even easier. In addition, you can invest in one or more ETFs that track the performance of the Japanese market index.

The new US Tech 125 Index provides Japanese investors with a good guide on which companies are good prospects for the future. Check out the information below for more about the opening & closing hours, break as well as holidays. Trading 212 is a global CFD broker, but clients can also trade stocks and ETFs free of charge. The company was founded in 2004 and is now headquartered in London. Trading 212 is regulated by the UK Financial Conduct Authority , the Cypriot Cyprus Securities and Exchange Commission , and the Bulgarian Financial Supervision Commission . His aim is to make personal investing crystal clear for everybody.

For example, the US stock market has outperformed the global and local Japan market four out of the last five years, and that has increased investor interest. ADRs are depository receipts issued by Japanese companies that can be purchased through your brokerage and traded on U.S. stock lmfx review exchanges. Most also offer a dividend payout and occasionally voting rights. The first disadvantage of trading US shares in Japan is that you need to buy dollars in the US before you can invest. The exchange rate can change overnight, which will affect your Japan investments.

Brokerage charges are fees imposed on Japan by brokers for the services they provide to their Japanese clients. They can include the cost of purchases and selling stocks and other securities, inactivity fees, research and investing help, and paper statements. In some cases, these fees may be in addition to account maintenance and administration fees. Experienced Japan traders often trade assets from different countries provides a better portfolio diversification for Japanese stock traders. Diversifying financial instruments in Japan, may specultively increase returns. US Growth stocks are those of companies that have experienced rapid growth and should be of interest to Japan traders interested in US stocks.

The minimum deposit is usually $0 or a low amount, but some brokers demand a couple of thousands dollars/euros. Many brokers also let you deposit funds using credit or debit cards. A few will also accept so-called electronic wallets such as PayPal, Apple Pay, Skrill or Neteller.

What is the best way to invest in Japanese stocks?

It contains 225 large, blue-chip stocks, representing the Japanese stock market. The Nikkei is a price-weighted index just like the DJIA. Companies are ranked by stock price instead of market capitalization. Choosing a diversified portfolio should be a goal for all investors in Japan.