Or, you might lose track of critical transactions that affect your taxes. Speaking of expenses, one of the most common mistakes attorneys make is losing track of business expenses. It’s best to capture and record your business expenses on the daily, so you don’t lose those receipts or invoices.

This is an attempt not to let the staff member, who is typically an admin, be handed the bookkeeper role. The admin usually will share with me that they don’t like doing the bookkeeping. They may be a paralegal or someone hired to do other work and then, by default, because they were good at their job, ended up having the bookkeeper role assigned. In a law firm, payables refer to the money owed by the firm to its vendors, suppliers, and other service providers.

Individual Business Owners

By taking the time to find the right person for the job, a law firm can ensure that its finances are well-organized and accurate. For example, an accountant who is also a bookkeeper can help with the organization and categorization of expenses. This is important because it can save time when preparing tax returns or other financial reports. Furthermore, the accountant can offer suggestions on how to improve the bookkeeping system. This can be done by setting up different income and expense accounts for each partner, as well as setting up a trust account to track client funds. This can save the firm money in the long run and help to maintain accurate records.

You can use it to capture bills and receipts, categorize and reconcile your bank account transactions, and get detailed reports on the health of your business. We reviewed many legal accounting software options loved by law firms, and came up with a list of the 10 best apps you should know. Whether it’s mixing up your business and personal transactions or deducting an expense from the wrong client trust account, it’s easy for law firm owners to record transactions incorrectly. Staying on top of your law firm’s accounting responsibilities while providing legal services to clients can be a significant challenge.

Law Firm Accounting and Bookkeeping: Tips and Best Practices

Nevertheless, many attorneys fail to separate revenue that covers incurred costs from their actual income. Failure to allocate appropriately can lead to inaccurate books, and battle compliance issues. An IOLTA account is a pool, interest-bearing business checking account for the deposit of client funds which interest earned belongs to the Lawyer Trust Fund. Although the roles https://www.bookstime.com/ of bookkeeping and accounting are different, there is a thin line to distinguish between them. Poor accounting practices, such as struggling to track billable hours or sending out invoices late, can lead to money leakage. Ensuring that costs are accurately billed to the client may seem easy, but it can actually be quite complex depending on how you handle billing in general.

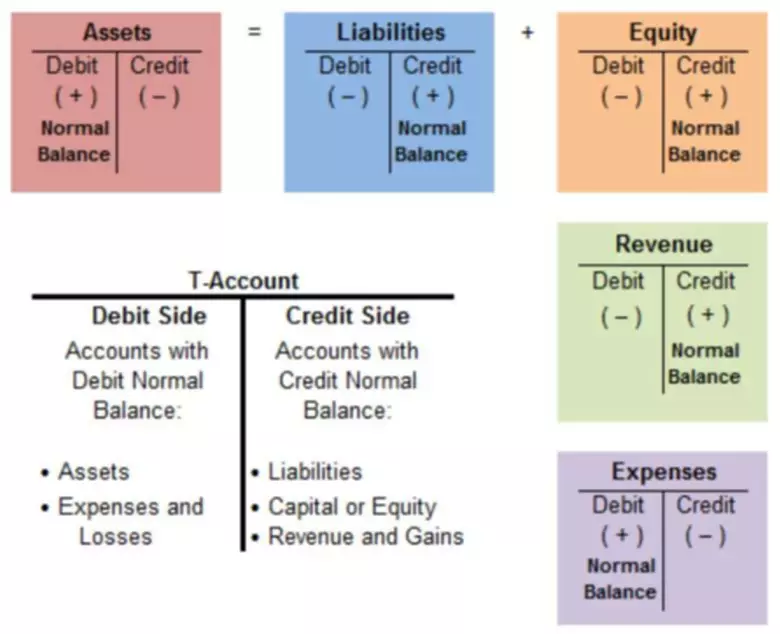

In a law firm, receivables refer to the amount of money owed by clients for legal services provided. This includes fees for hourly billing, flat fees, contingency fees, or other types of legal fees. Receivables are typically recorded as assets on the law firm’s balance sheet and are an essential part of the firm’s cash flow management. Regardless of the size of your law firm, it’s important to know accounting and bookkeeping basics to ensure that your business is compliant with ethics rules.

Mismanaging trust accounts

You can’t, for example, pay for your firm’s operating expenses directly out of an IOLTA account. Some firms will also intentionally use their IOLTA accounts to hide assets, or will leave funds in their IOLTA even after they’ve been earned, using it as a savings law firm bookkeeping account. Accounting for law firms may be new or challenging to you, but it doesn’t have to be scary. What’s most important is that you get the details right so that you can stay compliant with ethics rules and help your firm grow to its full potential.

In order for your law firm to be successful, it’s essential to create a budget. A budget will act as your road map in keeping your firm on track while pursuing those goals. With accrual accounting, revenue and expenses are recognized when they are earned and incurred. Accounts payable and accounts receivable are recognized in accrual accounting. Cogneesol has completely streamlined our client onboarding and setup process. With client accounts being updated on a real time basis now, our income, therefore, follows a structured flow.

IRVINE BOOKKEEPING

An example of a compliance regulation violation could be mishandling client funds. Get timely and reliable financial information about your firm so you can monitor your performance and make data-driven business decisions. With ProFix on your side managing the numbers, you can have more time back in your day to focus on your caseload.